J.P. vs. J.P.

Jeanine Pirro’s criminal investigation of Fed Chair Jerome Powell over a long-term, publicly reviewed Fed building project and over Powell’s related testimony is dominating the headlines. We assess ma

Jeanine Pirro, United States Attorney for the District of Columbia since May 2025, former Fox News personality, and best-selling author, is identified by reports as being the driver of the criminal investigation announced regarding the Federal Reserve and Jerome Powell. Multiple reports indicate that Pirro did not seek prior approval from her superiors at the Department of Justice or from President Trump before announcing her investigation.

For his part, President Trump has stated in an NBC interview that he didn’t know a thing about the DOJ’s launching a criminal investigation into Jerome Powell’s management of the renovations of Federal Reserve buildings and Powell’s testimony before the Senate Banking Committee back in June 2025:

I don’t know anything about it, but he’s certainly not very good at the Fed, and he’s not very good at building buildings.

Trump added,

I wouldn’t even think of doing it that way. What should pressure him is the fact that rates are far too high. That’s the only pressure he’s got.”

(“’I don’t know anything about it’: Trump denies involvement in DOJ’s Fed subpoenas” | NBC News, https://www.nbcnews.com/politics/donald-trump/trump-denies-involvement-doj-fed-subpoena-jerome-powell-rcna253526)

Even Federal Housing Finance Agency Director Bill Pulte — one of Trump’s fiercest political attack dogs and a key player in the administration’s yearlong Fed offensive — told POLITICO that the DOJ investigation was outside his purview and that he didn’t “know anything about it.” (It was Pulte, of course, who originated the attack on Lisa Cook.)

We have had a DOJ personality — not a central banker, not an experienced Treasury or finance person — articulating that she is launching a criminal investigation on an outgoing Federal Reserve Chairman who has limited months left on his term as chairman. That’s how we got into this Federal Reserve mess.

What to do with Jeanine Pirro is not up to me. Whether or not there was criminality (which doesn’t seem to be evident in a building project that has had scrutiny under the Trump administration and Biden administration and the general accounting office and everything else), I don’t know. But the disruption that Jeanine Pirro has caused in global finance is evidenced in financial markets and is, in my opinion, a detriment to the policies of the United States to the extent that it has the potential to imperil the independence of the Federal Reserve.

Whether you agree with the president’s policies or don’t agree with the president’s policies, whether you think the interest rate should be higher or lower, whether you think the Federal Reserve has done a good job or a bad job is all subject to a debate, but what is not subject to a debate is that Jeanine Pirro caused a crisis in confidence in the American payment system, the American currency, and the function of the dollar as a reserve currency. That is the key issue. Any substantive attack on Fed independence has enormous implications.

Jerome Powell released a statement regarding the investigation on Sunday, January 11:

“Statement from Federal Reserve Chair Jerome H. Powell” | Federal Reserve, https://www.federalreserve.gov/newsevents/speech/powell20260111a.htm

The tsunami of responses that followed saw Pirro attempting to clarify and downplay the significance of the investigation and thereby mitigate the damage.

On Monday, January 12, Pirro posted on X:

The United States Attorney’s Office contacted the Federal Reserve on multiple occasions to discuss cost overruns and the chairman’s congressional testimony, but were ignored, necessitating the use of legal process—which is not a threat.

The word “indictment” has come out of Mr. Powell’s mouth, no one else’s. None of this would have happened if they had just responded to our outreach.

This office makes decisions based on the merits, nothing more and nothing less. We agree with the chairman of the Federal Reserve that no one is above the law, and that is why we expect his full cooperation.

She defended the investigation on FOX News (YouTube), downplaying its seriousness:

Whatever our personal perspectives regarding Judge Pirro’s action, Fed Chair Jerome Powell and his response, or Trump’s involvement or lack thereof, there are potential market impacts of a criminal investigation of a Fed chair that require analysis and consideration.

The rest of today’s effort is devoted to market analysis, global response, Fed issues, and some final comments. Let’s begin with various markets and their reactions.

Market Reactions

Since U.S. Attorney Jeanine Pirro announced the criminal investigation into Federal Reserve Chair Jerome Powell on January 11, 2026, the US dollar has generally weakened against major currencies due to heightened political uncertainty and concerns over the Federal Reserve’s independence.

I also checked the changes in credit default swap prices (daily) on US sovereign debt as the J.P vs. J.P. saga unfolded. Initially, there was additional weakness. At the end of the week, pricing was within a basis point or two of the level we showed in the chart on January 11 when we discussed the Lisa Cook Affair and its impact on market prices of credit insurance on American sovereign debt.

Predictably, gold and silver prices rose sharply, given a new level of uncertainty regarding the Fed’s future ability to act solely as economic data and its analysis dictates, independently of political influence. Gold rose from $4,510 per ounce on Monday, January 11, to $4,634 by Wednesday, January 16, after hitting an all-time high topping $4,650 per ounce earlier that day. It finished the week somewhat lower, at $4,589 per ounce, in the wake of strong criticism of the investigation and Jeanine Pirro’s attempts to ease concerns somewhat.

Following the same pattern, silver outpaced gold after the announcement of the investigation, rising from $79.92 per ounce on January 11, 2026, to $93.18 on January 14, 2026, before dipping to $90.04 by the close of day on Friday, January 16.

“Wall Street, former Fed officials slam Powell probe” | MSN, https://www.msn.com/en-us/money/markets/latest-threat-to-fed-chair-powell-rattles-markets/ar-AA1U3YI4

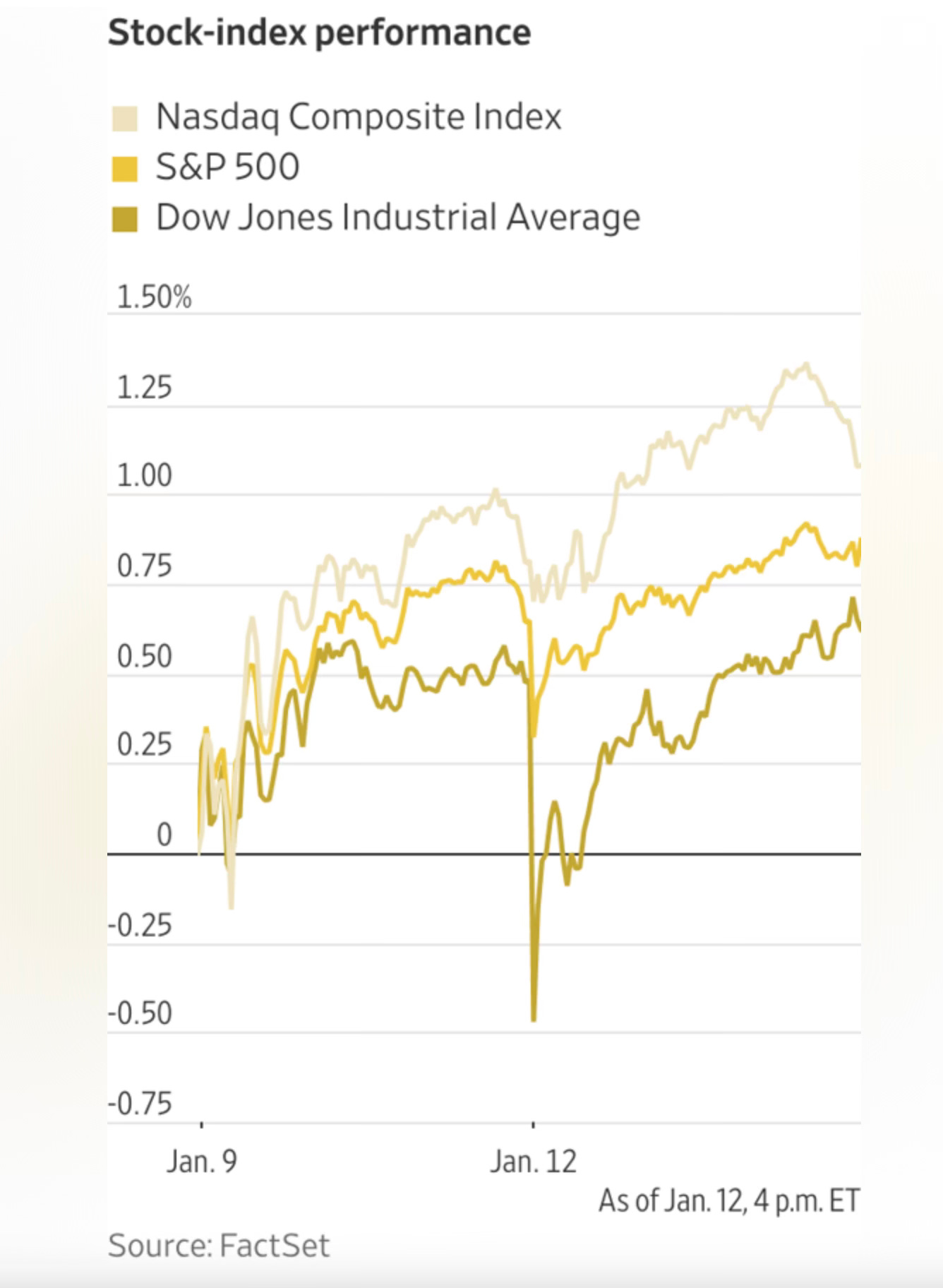

Market reactions traced the vehemence of initial alarm and a moderated threat assessment as the week progressed:

Most importantly, the Pirro-Powell clash quickly indicated how the markets will respond to any substantive attack on Fed independence.

Responses from Market Agents and Prestigious Personalities

David Rubenstein offered his take on Powell’s response and suspects that Pirro’s subpoenas will not segue to a criminal case. See the final segment of Wednesday’s edition of Bloomberg Surveillance, starting at 2:16:38.

Some markets have been resilient. Here’s a comment from Nicholas Colas and Jessica Rabe of Datatrek in their January 13 Morning Briefing.

For all the headlines, markets continue to believe the Federal Reserve will remain politically independent. This is visible in both longer dated (2 year) Fed Funds Futures and expected annual inflation imbedded in 10-year Treasuries. Against that backdrop, it is worth remembering that long run equity returns are fundamentally a function of human ingenuity and the societal systems that support it.

Representative French Hill, who serves as Chairman of the House Financial Services Committee, issued this statement:

I’ve known Chairman Powell since we worked together at Treasury during the George H.W. Bush Administration. Then, as now, I know Mr. Powell to be a man of integrity with a strong commitment to public service. While over the years we have had our policy disagreements, I found him to be forthright, candid, and a person of the highest integrity.

Pursuing criminal charges relating to his testimony on building renovations at a time when the nation’s economy requires focus creates an unnecessary distraction. The Federal Reserve is led by strong, capable individuals appointed by President Trump, and this action could undermine this and future Administrations’ ability to make sound monetary policy decisions.

We must stay focused on our work to foster more opportunities with higher wages and faster economic growth for the American people.

( RELEASE: REP. FRENCH HILL STATEMENT ON FEDERAL RESERVE CHAIRMAN POWELL” | US Congressman French Hill, https://hill.house.gov/news/documentsingle.aspx?DocumentID=9741)

Janet Yellen (Fed chair 2014–2018, Treasury secretary 2021–2025) offered her assessment:

We’re in uncharted territory. My sense is that [Treasury Secretary Scott] Bessent and others see this as a huge mistake with a great deal of downside risk. I think a lot of people saw Powell’s statement and were really impressed with his integrity and see him as a person who has the interests of America at heart. Even if they don’t understand monetary policy, they see him as somebody one should look up to, who is defending the public interest. So far, we haven’t seen a lot of market reaction. I think that’s because markets don’t really think much is going to change in the immediate future. But you could see a huge market response if it looks like Trump’s actions will change Fed decision-making. Powell has not said if he’s going to stay or leave [as a Fed governor] after his term as Fed chair expires [in May], and maybe Trump is trying to pressure him into leaving, but Powell’s interest in staying is probably higher if he sees the Fed’s independence is seriously under threat. Maybe somebody had the misguided notion that this was a good way to pressure Powell to leave. But if that was the idea, it’s backfiring. I think this is widely viewed now as akin to shooting oneself in the foot.

Yellen’s comments are excerpted from an extended discussion:

“Five Questions for Janet Yellen on the Fed, Powell and Trump” | Bloomberg Businessweek Daily, https://www.bloomberg.com/news/newsletters/2026-01-15/former-fed-chair-janet-yellen-on-jerome-powell-doj-probe-trump-s-threats

Every living former Fed chair signed the following joint statement regarding the criminal investigation launched by Jeanine Pirro:

The Federal Reserve’s independence and the public’s perception of that independence are critical for economic performance, including achieving the goals Congress has set for the Federal Reserve of stable prices, maximum employment, and moderate long-term interest rates. The reported criminal inquiry into Federal Reserve Chair Jay Powell is an unprecedented attempt to use prosecutorial attacks to undermine that independence. This is how monetary policy is made in emerging markets with weak institutions, with highly negative consequences for inflation and the functioning of their economies more broadly. It has no place in the United States whose greatest strength is the rule of law, which is at the foundation of our economic success.

(“Statement on the Federal Reserve,” January 12, 2026)

Senator Thom Tillis (R-NC), a senior member of the Senate Banking Committee who is not seeking reelection, posted the following statement on X on January 11:

If there were any remaining doubt whether advisers within the Trump Administration are actively pushing to end the independence of the Federal Reserve, there should now be none. It is now the independence and credibility of the Department of Justice that are in question.

I will oppose the confirmation of any nominee for the Fed—including the upcoming Fed Chair vacancy—until this legal matter is fully resolved.

.See also“GOP senator: DOJ ‘credibility’ is ‘in question’ over Powell investigation” | The Hill, https://thehill.com/homenews/senate/5684255-thom-tillis-doj-jerome-powell/

The investigation has almost no support, though Florida Rep. Anna Paulina Luna has been an exception. Politico Playbook noted on January 13 that, on FOX News,

Only Laura Ingraham mentioned the Powell case on her evening show, though she didn’t sound too impressed with the DOJ. “I tend to agree with Treasury Secretary Scott Bessent, who believes any such investigation is probably unwise,” Ingraham told viewers.

(“The Powell disasterclass” | Politico Playbook, https://www.politico.com/newsletters/playbook/2026/01/13/the-powell-disasterclass-00724118?nname=playbook&nid=0000014f-1646-d88f-a1cf-5f46b7bd0000&nrid=0000015c-3812-d67e-adff-ba7ac1a30001)

Larry Kudlow, on FOX, could not refrain from chuckling when he said of Powell,

I don’t think he’s a criminal. I mean, here, let me put it to you this way. In Washington DC cost overruns are — that’s the currency. There aren’t enough jails to throw people into for cost overruns, okay…. I think the District of Columbia jumped in too soon.

(“Fox’s Larry Kudlow calls for Jeanine Pirro to drop Jerome Powell investigation” | MSN, https://www.msn.com/en-gb/politics/government/larry-kudlow-calls-for-jeanine-pirro-to-drop-powell-investigation/ar-AA1UmrWG)

Harvard economics professor Jason Furman was heartened by “the broad reaction [to the investigation], from every corner, left to right, former economic officials, (JP Morgan CEO) Jamie Dimon, international central bankers, Republican and Democratic senators,” noting that “just about everyone was unified by this action.” But he believes markets may be too complacent about Fed independence over the next three to six years. Kathleen Hays interviewed Furman on Central Bank Central, and Furman’s analysis is a must-listen:

Powell Has Options

As Reuters economics reporter Howard Schneider notes and many readers know, Powell has the option of serving for two more years as a Fed governor, and he speculates that Powell might find good reasons to buck an eight-decade tradition and stay on for the remainder of his term:

As an institutionalist and member of what’s now regarded as the Republican Party’s old guard, a bipartisan figure who has been appointed, promoted, and supported by members of both major parties, including Trump, Powell may see the decision to stay as now nearly unavoidable if he feels the Fed’s independence is at risk and believes his continued presence might help defend it.

(“Poker-faced Powell may have ace up sleeve to stymie Trump’s Fed shakeup” | Reuters, https://www.reuters.com/business/poker-faced-powell-may-have-ace-up-sleeve-stymie-trumps-fed-shakeup-2026-01-16/)

Kotok View

We all see the world’s market and financial commentator’s reactions. We see gold prices and the foreign exchange value of the dollar and many other market-based price indicators. Those are real money bets, not talking heads of which there are many. I guess I’m one of them, too.

My 50-plus years in finance helps me to understand the fragile nature of global confidence in the US dollar and the US Federal Reserve. Remember the forthcoming SCOTUS ruling about Lisa Cook, with a range of possible outcomes from benign to a violet market reaction should Fed independence be imperiled, with implications for the role of the US dollar if trust falters in Fed independence and risk is perceived to rise. I wrote about this case and its potential impacts on January 11:

“SCOTUS Decision on Lisa Cook: Financial Market Impact?” | Kotok Report,

https://kotokreport.com/scotus-decision-on-lisa-cook-financial-market-impact/

The criminal investigation of Jay Powell shortly before the end of his term as chair similarly points to the potential for an enormously consequential outcome should an administration impinge on Fed independence.

Additional Reading

The Vital Importance of Central Bank Independence

There are resources aplenty for any serious reader to explore the issue of central bank independence, money, inflation, and what happens when monetary policy is driven by the executive government. Here’s short reading list from my personal library. (Caveat: The list is short; the reading is substantial.) Yes, I have read all of these.

Part 3 (pages 223–312) of our book The Fed and the Flu: Parsing Pandemic Economic Shocks(2025) offers an account of the creation of the Fed and an overview of its evolution.

A History of the Federal Reserve, Volume 1: 1913–1951, by the late Allan Meltzer. (Volume 2 was published in two parts — Book 1 (1951–1969) and Book 2 (1970–1986) — in 2010.)

Prices, by George F. Warren and Frank A. Pearson. A treatise about American inflation, Prices was published in 1933. Though a physical copy can be hard to find these days, the text can be viewed at the National Library of Australia: https://catalogue.nla.gov.au/catalog/1026262.

A Monetary History of the United States: 1867–1960 (1969), by Milton Friedman and Anna Jacobson Schwartz

A History of Interest Rates by Sidney Homer. (The currently edition is the 4th, by Sidney Homer and Richard Sylla.)

Background on the Building Project

“The $2.5 billion renovation at the center of the DOJ’s criminal investigation of the Federal Reserve” | NBC News, https://www.nbcnews.com/business/economy/25-billion-renovation-center-dojs-criminal-investigation-federal-reser-rcna253540

“Federal Reserve’s Renovation of Two Historic Buildings” | Board of Governors of the Federal Reserve System, https://www.federalreserve.gov/faqs/building-project-faqs.htm

David values thoughtful, reasoned, constructive responses from readers. To contact him, please send an email. The subject line should read “Response to [title of commentary].”

The complete Kotok Report archive can be found at www.kotokreport.com.